A Claims Filing Solution Designed to Maximize Your Recoveries

Securities Class Actions in the US can take as long as 5-8 years to litigate, plus an additional 18 months before you receive a payout. It takes a lot of time, effort, and resources to guide your claim from the beginning of the process to the end.

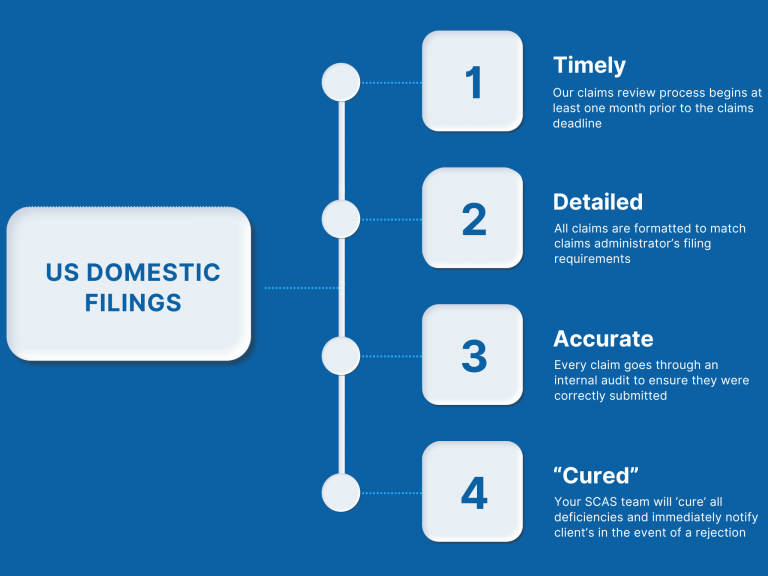

That’s why it helps to use an end-to-end claims filing provider like ISS SCAS. Filing securities class action litigation takes knowledge, experience, and expertise, and it’s the details that can often make a difference.

For example, unlike most other Securities Class Actions filing services ISS SCAS submits all claims a minimum of 2 weeks prior to the claims filing deadline. Why do we do this? By not leaving things to the very last minute, like some of our competitors, it leaves plenty of time to troubleshoot any issues, or submit anything that might have been missed.

Click the contact us button below to learn more.

SEC Fair Funds filings are very different from standard US filings and can be complex, and difficult to manage since the documentation requirements are significant. ISS SCAS has built a process specifically designed for the intricacies of an SEC Fair Fund Filing. To learn more about US Domestic Filings, or SEC Fair Fund Filing contact ISS SCAS using the button below.

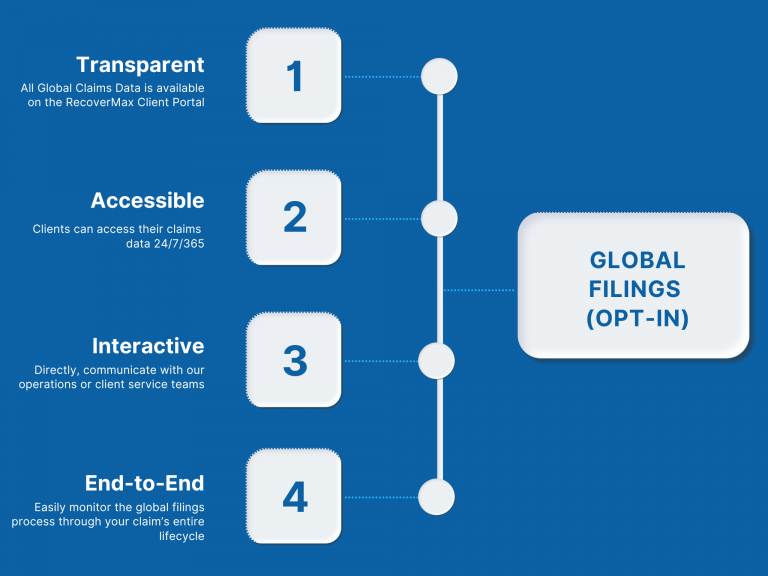

Global securities litigation has developed considerably since the Supreme Court decision in Morrison v. National Australia Bank in 2010. That decision significantly curtailed the litigation of securities claims in the United States for foreign listed securities. By using SCAS Global, clients can participate in securities class actions in over 20 jurisdictions outside North America.

Obtaining compensation for securities fraud globally is a very different process than in North America. There are a number of different legal jurisdictions and languages—which in itself adds complexity to the process and makes working with an experienced partner like ISS SCAS important, if not essential.

SCAS Global assists clients in identifying cases, working with and receiving information from the law firms litigating global cases. We also understand the unique requirements and challenges of each jurisdiction, and file the documentation required to participate in theses actions.

ISS SCAS provides coverage for clients on Antitrust Cases. Each Antitrust case is handled on a case-by-case basis, as the requirements for participation in each case are unique. For each litigation we monitor, clients are provided with case details and updates via our RecoverMax platform. For information on Antitrust filings use the contact button below.

Disbursement Processing

A System of Checks & Balances

The ISS SCAS disbursement team has a singular mission: ensure our clients get the money they are entitled to, the amounts are accurate, and sent to the right place. Over our many years of business ISS SCAS has continually refined our process for disbursing funds to our customers. We even built of our own disbursement processing solution system that adds a significant number of checks & balances, and built-in redundancies so we can be sure your money gets to you in a timely fashion, and with zero mistakes.

Take a look at the short video below for more details.